24 Regulation

One direct means of improving financial decision making is through regulatory obligations placed upon financial service providers.

Examples of regulatory interventions include:

- Cooling off periods: This prevents people making purchases made when they were in an emotional state (or enables them to unwind them), and provides an opportunity for reflection and price comparison.

- Restricting the use of certain defaults: As defaults are sticky, legislating the better default may improve outcomes. For example, financial advisers in Australia are now required to periodically renew the client agreement for ongoing fees, a change from the previous default arrangement of ongoing fees.

- Price caps: If competition in a market is for naive, price-insensitive customers, price caps can limit the damage. As noted earlier in this course, payday lending fees in Australia are capped. Price caps can, however, reduce supply if poorly targeted.

Three case studies are provided below.

24.1 Deferred sales for add-on insurance

Customer outcomes can often be improved simply by ceasing poor distribution practices. Add-on insurance provides an illustration of this.

Add-on insurance is an insurance product sold to accompany another financial transaction, such as purchase of a motor vehicle or a credit product. The add-on insurance then covers events associated with that other transaction, such as a motor vehicle accident. Consumer credit insurance, which we covered previously in Section 16.5, is typically sold as add-on insurance.

Add-on insurance is not usually offered up-front, but rather only at the completion of the purchase of the associated product. As a result, the customer has typically not prepared for the purchase of insurance, such as researching the market or shopping around. This means customers are often buying the first and only insurance product they see. They are more likely to accept very expensive offers and unlikely to choose the best deal available (as the add-on offer is rarely the best deal). The relativity of the add-on price to the primary product (e.g. a car) also reduces the attention given to the add-on price. Further, some consumers are confused about whether they are required to purchase the insurance as a condition of buying the product (Iscenko et al. (2014)).

Australia has introduced regulation implementing a deferred sales model for add-on insurance providers. Add-on insurance should not be offered until four days after the sale of the product to which it relates. A deferred model is intended to make the price of the add-on more salient, increase the likelihood of price comparison or shopping around, and enable decision making at a time when they may be experiencing decreased cognitive load. It might also remove any confusion about the insurance being a condition of the purchase.

24.2 Mandated disclosure

We have seen in this book that the information provided to customers, whether in the form of marketing, more formal information provision, or advice, can affect customer decision making and financial wellbeing. This opens the door, at least theoretically, for mandated disclosure to improve outcomes.

However, the evidence for the positive effect of mandated disclosure is limited. Disclosure is often found to be inadequate to overcome fundamental problems with products, and can sometimes backfire.

One of the main barriers to disclosure is that complexity is hard to explain simply. If a product is complex, no amount of disclosure can change that. People can hold only a small number of chunks in their mind, and even if the language is plain, they will have that fundamental constraint.

The other barrier is that disclosure is typically implemented by self-interested firms. The idealised implementation wanted by a regulator and actual implementation are often markedly different. For example, find the required warning label on the homepage for Nimble.

Achieving the desired effect with disclosure is also difficult. Below is one example.

24.2.1 Superannuation disclosure

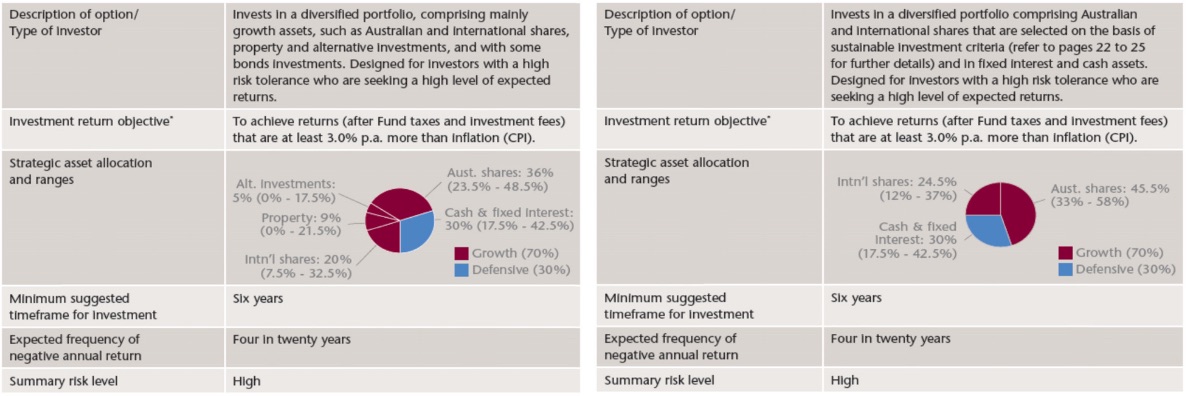

Australian superannuation funds are required to provide short product disclosure statements to customers. They are designed to be shorter than historic product disclosure statements and enable people to compare superannuation products across areas such as risk, returns and asset allocation.

Bateman et al. (2016) examined the effect of the standard information in these documents on consumer choice (using Unisuper templates as a foundation). They found that one third of consumers were not affected by the information provided and the risk information was irrelevant to three quarters.

The most influential element of the dashboard was the asset allocation pie chart. Customers preferred options where the assets were allocated evenly across the categories. This finding opens the potential for manipulation of choice by changing the asset categories such that allocations appear more even.

24.2.2 Disclosure of conflicts of interest

Earlier in this book we saw evidence that financial advisers often act in their own interest when giving advice to customers. Customers also appear to be naive as to these effects.

One possible intervention to overcome this conflict is to require disclosure of conflicts. However, there is experimental evidence that this could backfire.

Cain et al. (2005) found in a lab experiment that when conflicts of interest are disclosed, advisers give even more biased advice. This may be due to moral licensing, or a strategic response as the adviser believes they need to be more extreme in their recommendation in anticipation that their advice will be discounted. Consumers also fail to discount the advice due to the conflict as much as they should, even though disclosed. The net result is that disclosure could worsen outcomes.

Sah et al. (2013) showed in another lab experiment that although disclosure can decrease trust in advice, it can create a perverse incentive for the customer to follow the advice. Failure to follow the advice would signal that they don’t trust the adviser, creating social pressure to give in to the adviser’s interest. Given the nature of this particular effect, disclosure of the conflict by an external party or an opportunity to make the decision to follow advice in private reduced the extent of this unintended consequence.

24.2.3 Listen

Sunitah Sah is interviewed on the BETA podcast.